What is Support Center?

Support Center is a tool that helps the customer relationship division within a Fintech to better manage its customer interactions. Support centre provides comprehensive dashboards and tools using extensible integrations to help resolve customer issues quickly, track customer engagements, and capture interaction and performance data. It can be operated either by an internal department or outsourced to a third-party provider.

Getting Started

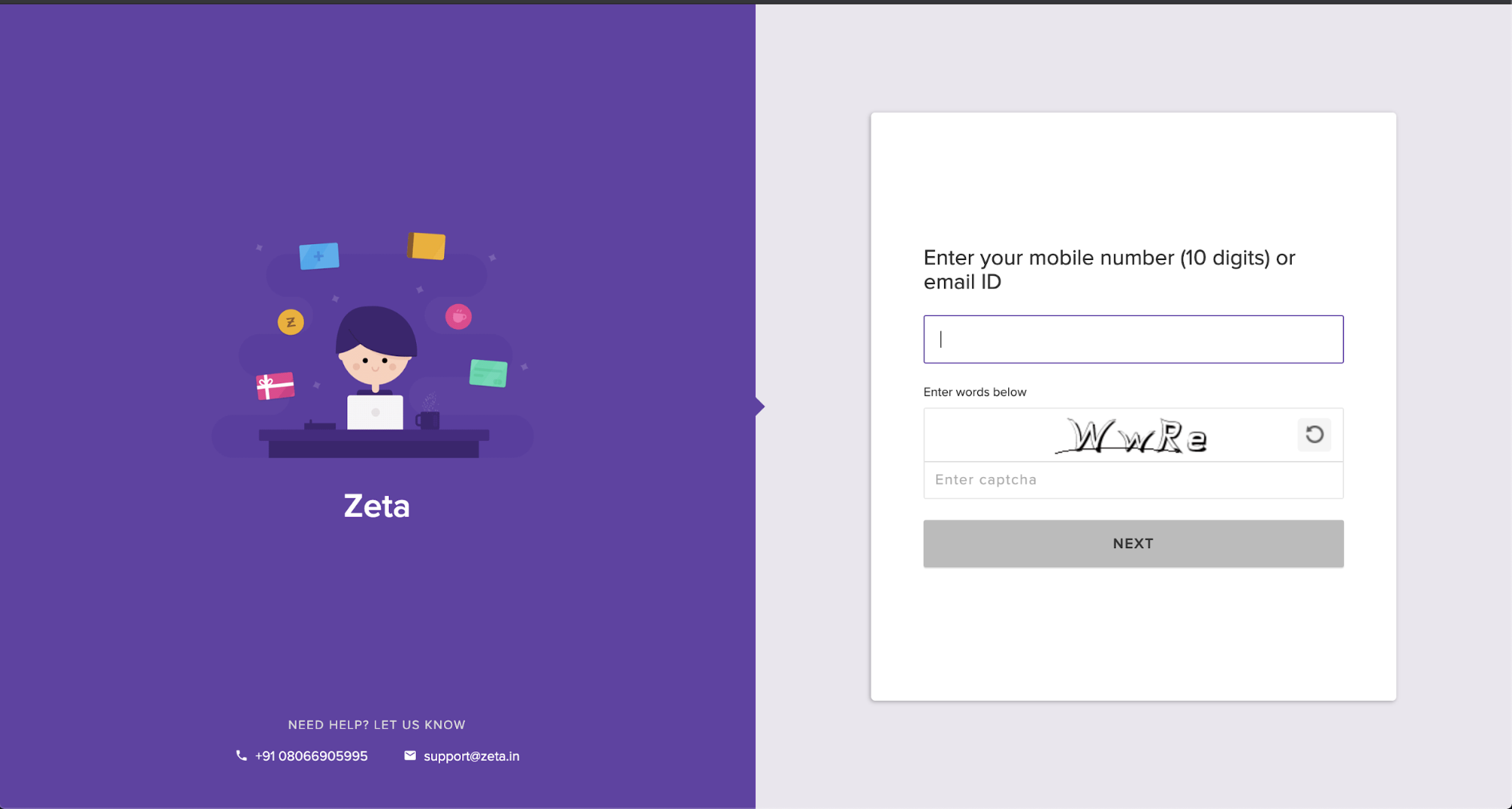

Logging In

Support executives with access to an instance of support center can login to it via:

- Entering their 10 digit phone number or email ID.

- Verifying the identity via OTP sent to the registered phone or email.

Landing Page & Profile Search

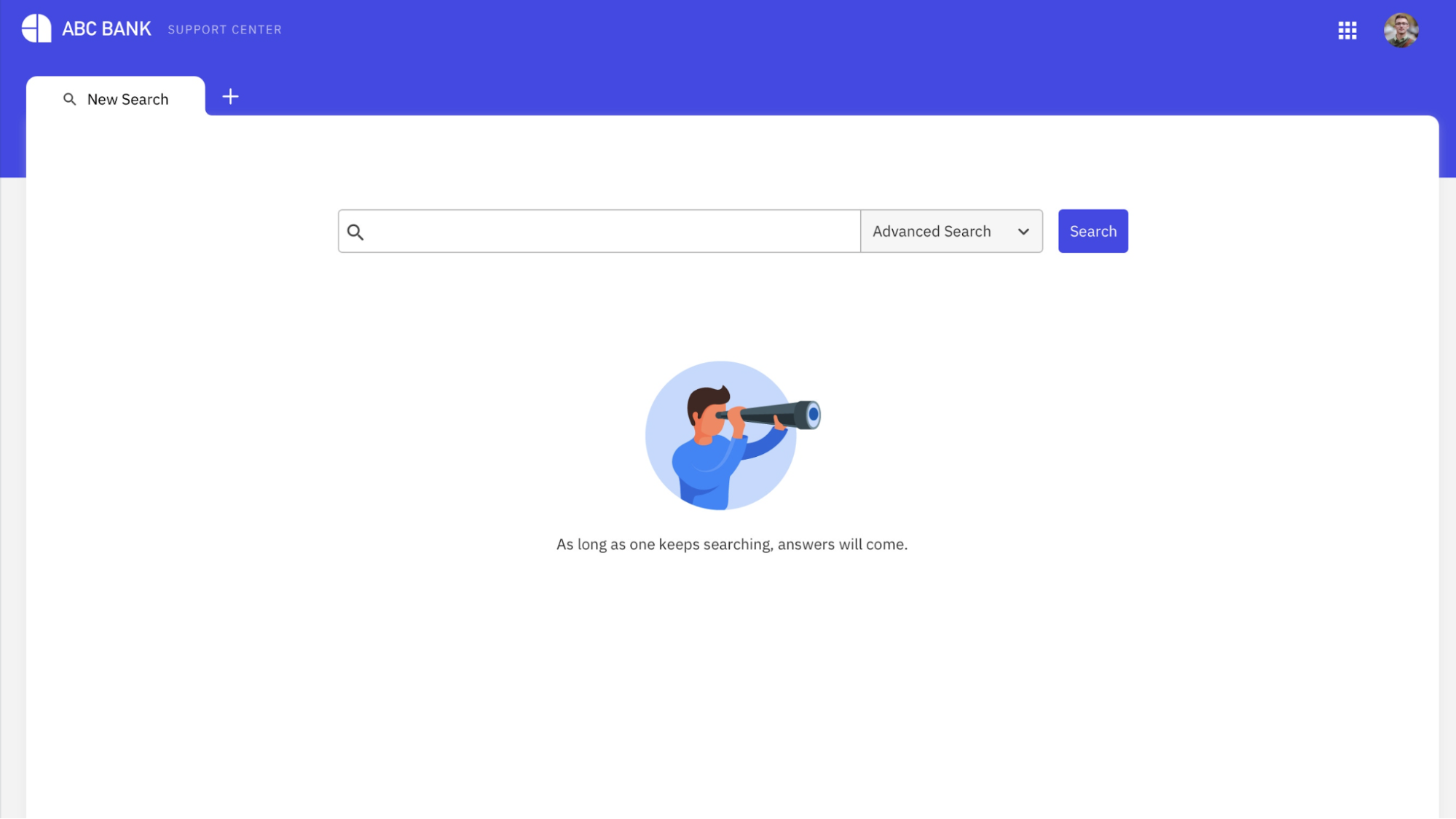

Default Landing Page

On the default landing page, Support center presents the support executive with an option to search for any account holder associated with Fintech.

Search

Support executives can search for a profile by entering the details of the account holder.

The profile attributes required for searching any account holder may differ for each issuer and can be configured during support center setup. The following search attributes are enabled by default:

- Name

- Phone Number

- Email ID

- Account Holder ID

- Card Number

- CRN

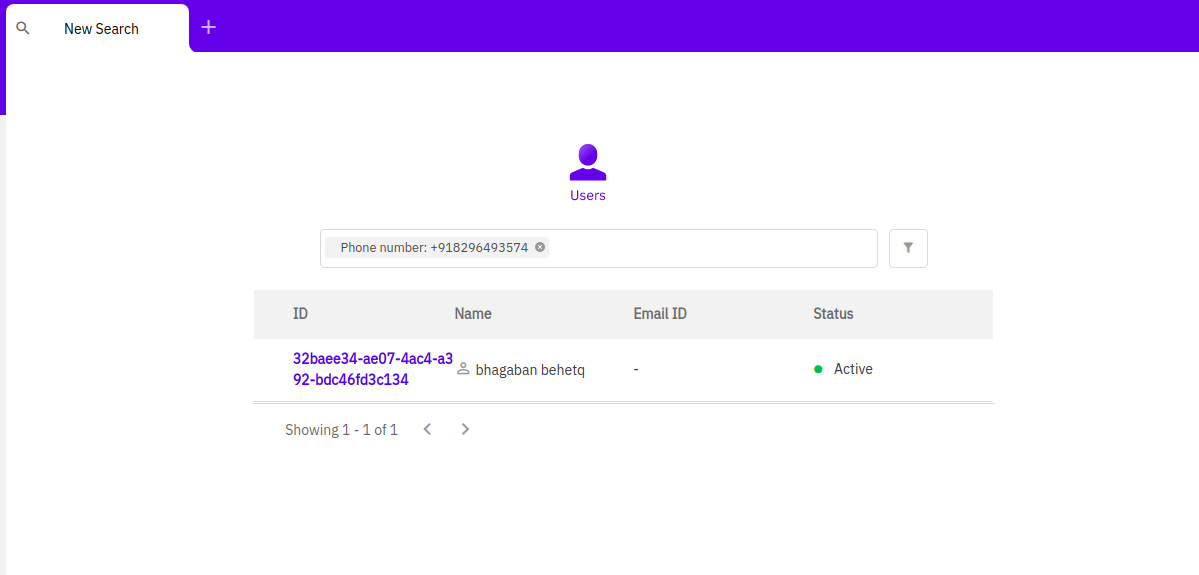

If any account holders are found that match search values then the results would be shown on the screen in a paginated fashion. The following attributes for all matching account holders are shown by default:

- Account Holder ID

- Name

- Phone or email

- Account Holder Status

The profile can be accessed by clicking on the Account Holder ID.

Real Account Holder or User Profile

As described above, a real account holder is an individual who can be identified and authenticated using various identifiers and authentication procedures prescribed by the regulatory bodies and configured by the issuer. This view is only available to issuers who have products configured that require real account holders.

Support center organises information available for every real account holder in the following sections.

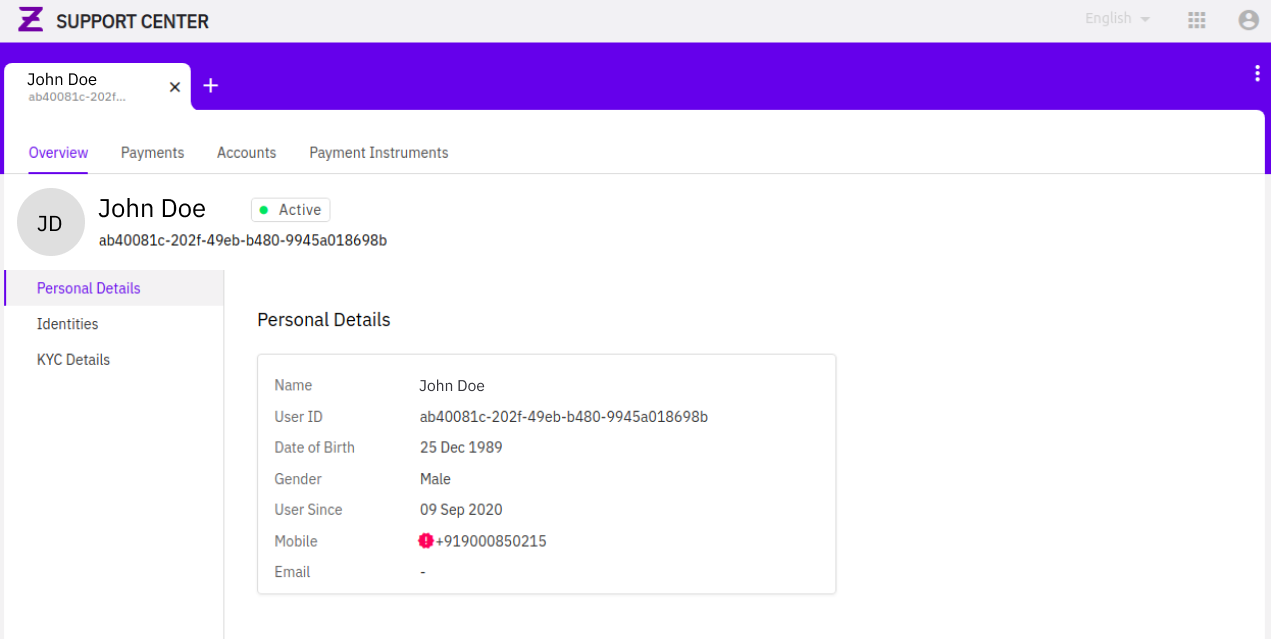

Overview Tab

This tab collates all personal, professional and KYC related information of the account holder.

Details Captured

The following information is displayed as available for every account holder:

- Personal details

- Full Name

- User ID

- Data of Birth

- Gender

- User Since

- Mobile

-

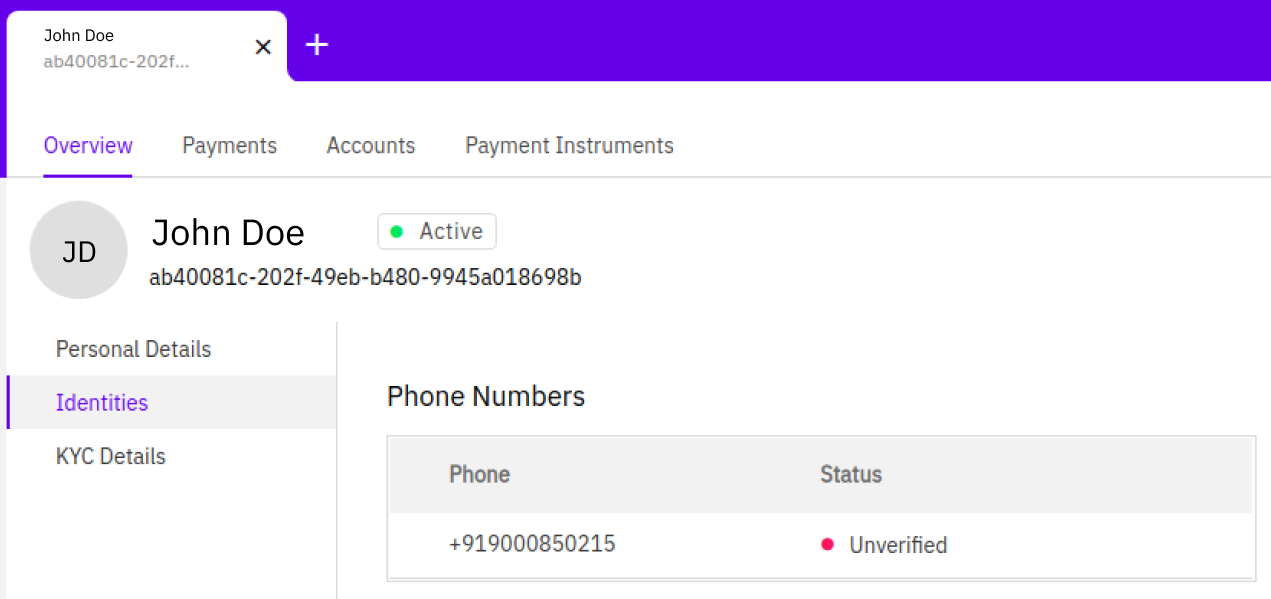

Identities

This refers to any unique vectors associated with the account holder with their verification status. Available vectors today are:

- Mobile Number

-

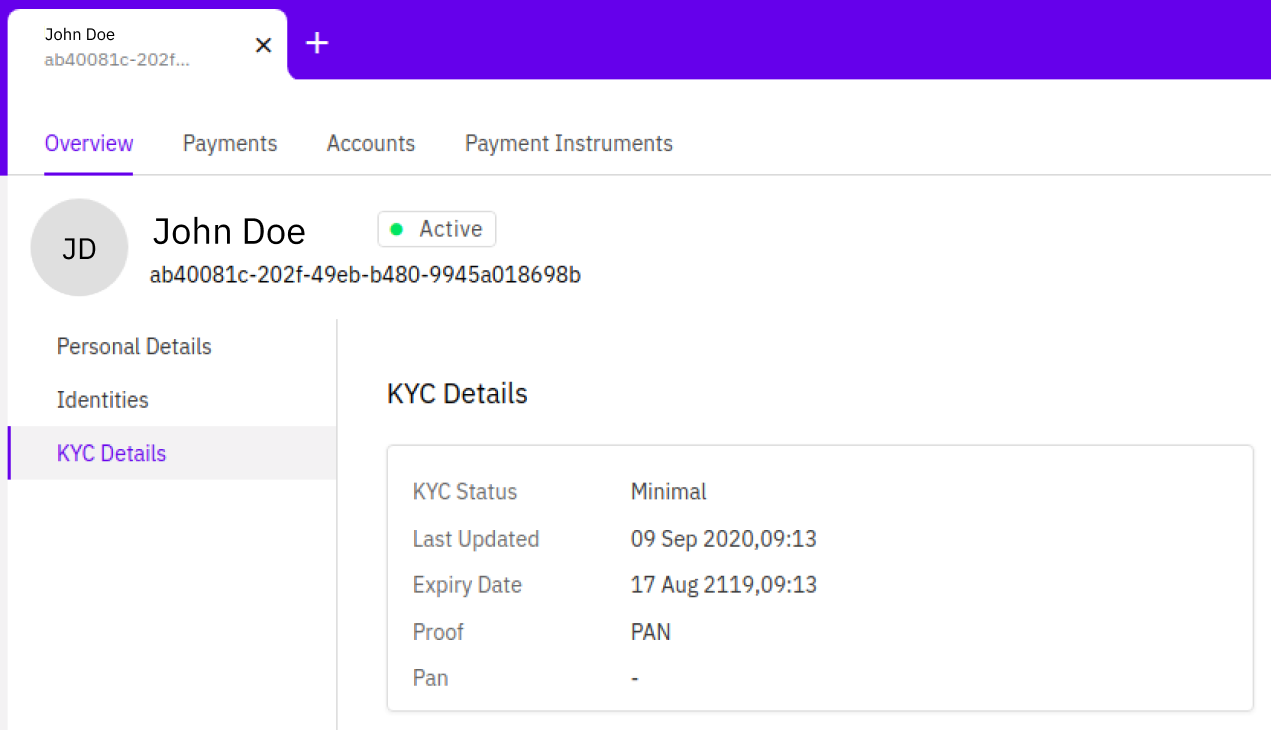

KYC Details

The following details are shown for every Account Holder basis availability:

- KYC status

- Last Updated

- Expiry Date

- Proof

-

More Details

The following details are shown for every Account Holder:

- Passphrase Set

- Second factor Set

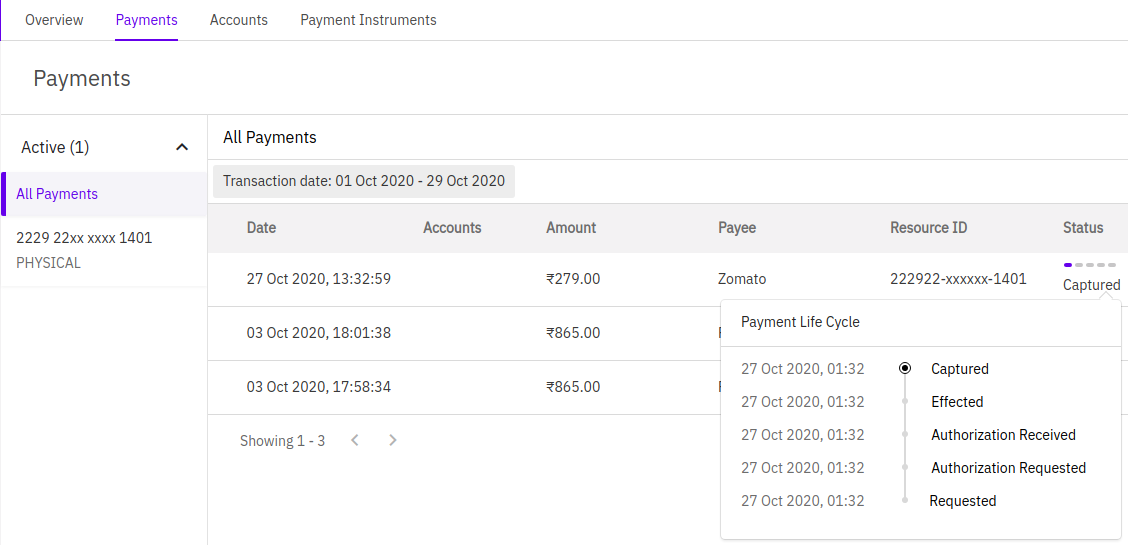

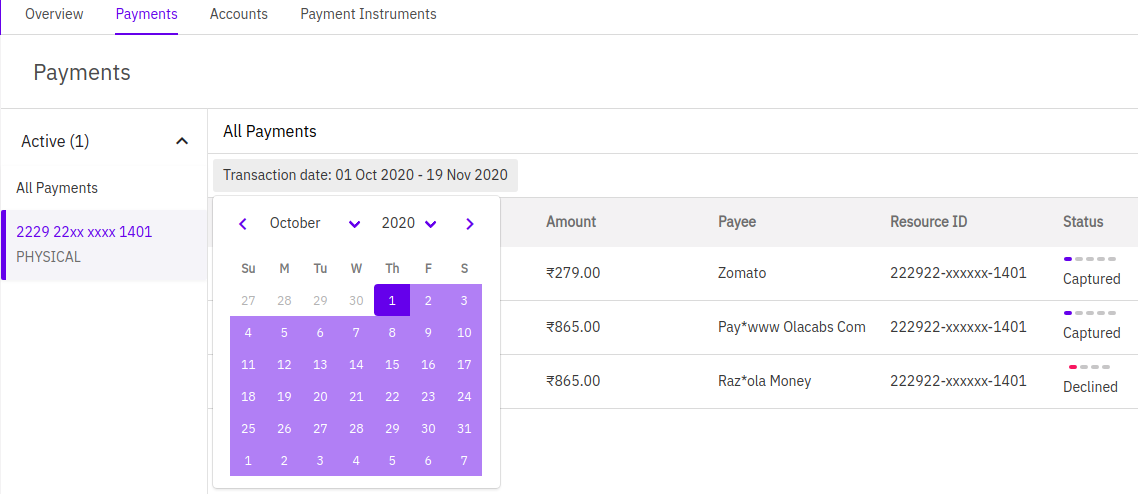

Payments Tab

This tab collates all payments attempted, successful or failed, by the user. It also provides a very detailed breakdown of the entire payment lifecycle. All payments attempted since 1st April 2020 all transactions should be accessible on Support Center.

Details Captured

The following details are currently captured on the Payments tab:

- Transaction ID

- Date of transaction

- Accounts involved

- Amount for which the payment was initiated

- Balance Before

- Balance After

- Payee

- Payment Status

- Payment Lifecycle with timelines

Support executives can also filter the payment list by:

- Transaction date

- Transaction ID

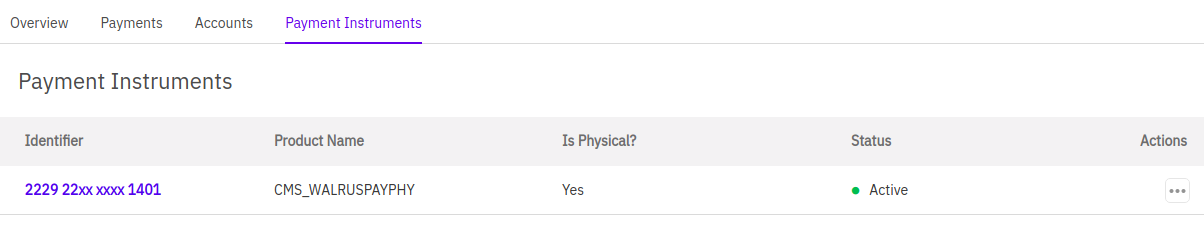

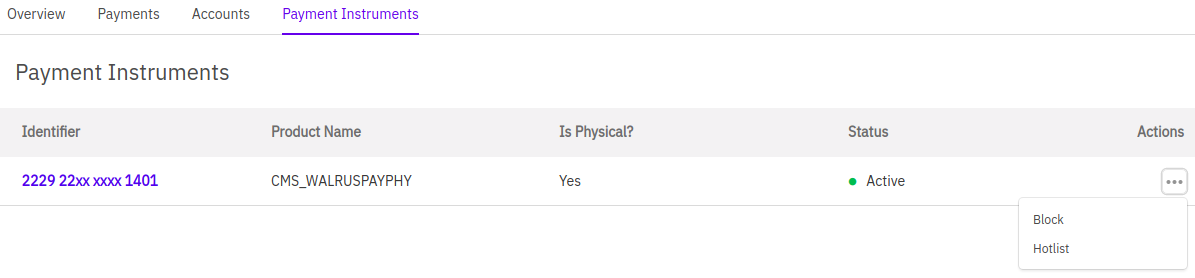

Payment Instruments Tab

This tab provides a consolidated view of all the payment instruments associated with an account holder.

Details Captured

The following details are shown for every payment instrument:

- Unique Identifier e.g. Masked Card Number

- Type

- IsPhysical?

- Status (Supported States: Active, Blocked, Hotlisted)

- Actions - Option to Block or Delete and Replace the payment instrument

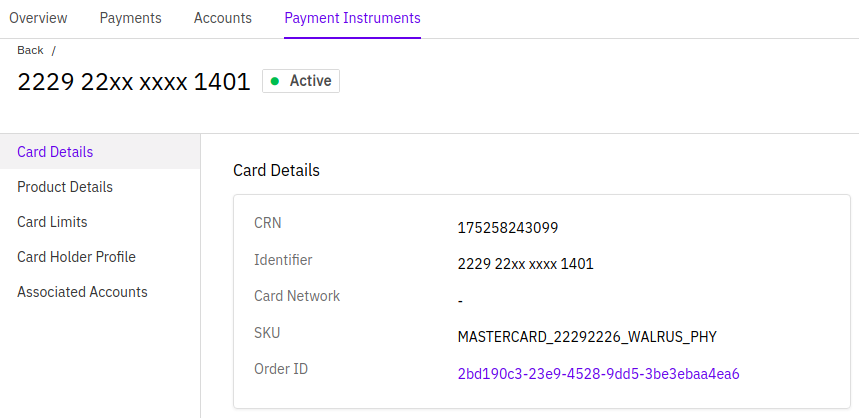

The following additional details can be revealed for every payment instrument on clicking the identifier. This screen differs for every payment instrument type.

For a card payment instrument the following additional details are shown:

- Overview

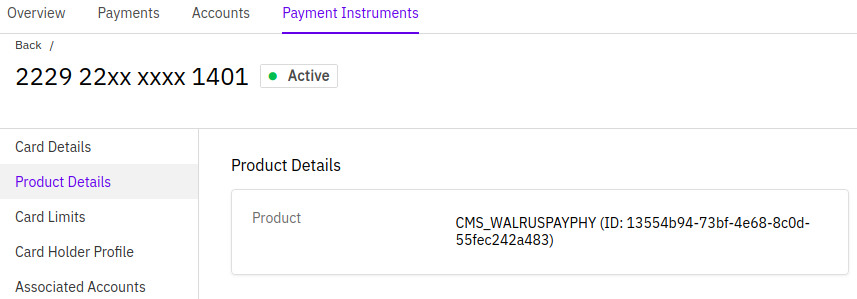

- Product Details

- CRN

- Card Number

- Card Network

- SKU

- Order ID

- Card Status

- Card Expiry

- Order Details

- Associated Accounts and Balances

- Product Details

- Card Holder Profile

- CIF

- Primary Account Holder

- Card Holder’s Number

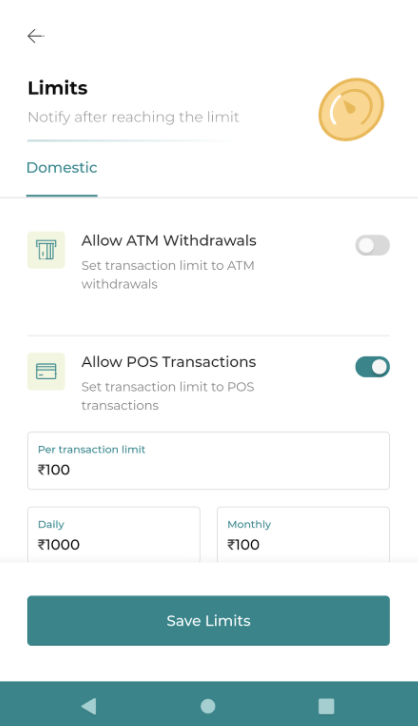

- Card Limits by Transaction category:

- POS Transaction

- E-Comm Transaction

- ATM Withdrawals

Allowed Actions

-

Block/Unblock Card

Feature highlight is as follows:

- This is a temporary block applied on the card that can be reversed.

- All Blocked cards show up with ‘Blocked’ status on Support center.

- Blocked cards can be:

- Unblocked using

Unblock Action - Permanently deleted using

Delete and Replace

- Unblocked using

- This action doesn’t require any checkers to be completed.

-

Delete and Replace

Feature highlight is as follows:

- This is a permanent delete applied on the card that cannot be reversed.

- Support executive needs to choose a reason for deleting and provide a description.

- Support executive can also request a Card Replacement. Card replacement request is only possible while the card is being deleted.

- This action doesn’t require any checkers to be completed.

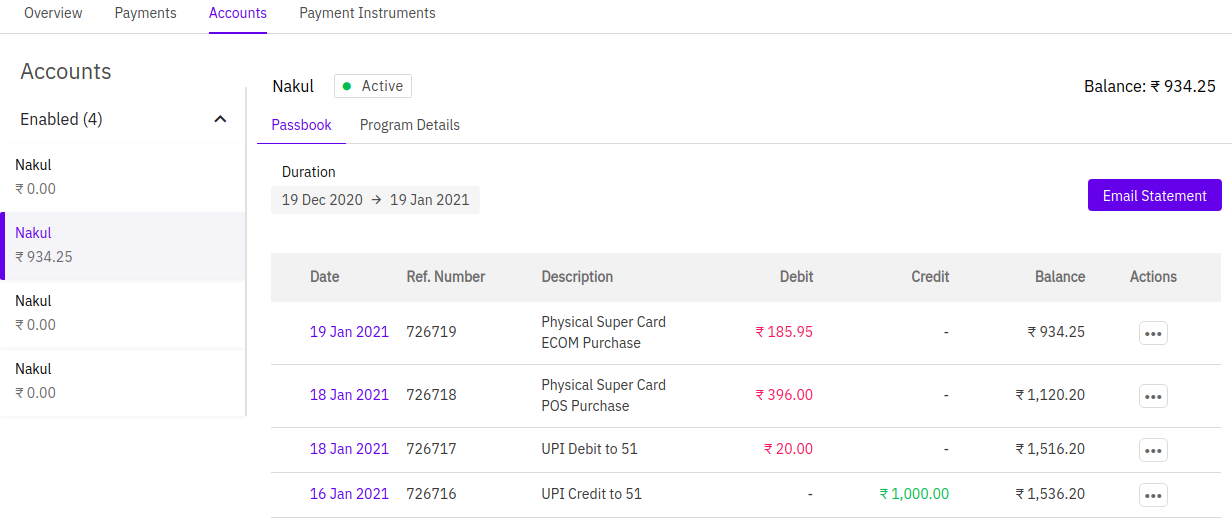

Accounts Tab

Details Captured

-

Program Details

This tab provides a consolidated view of the program details for the account.

- Basic details of the account

- Product details

- Transaction policy

Allowed Actions

The following actions can be taken on every associated account:

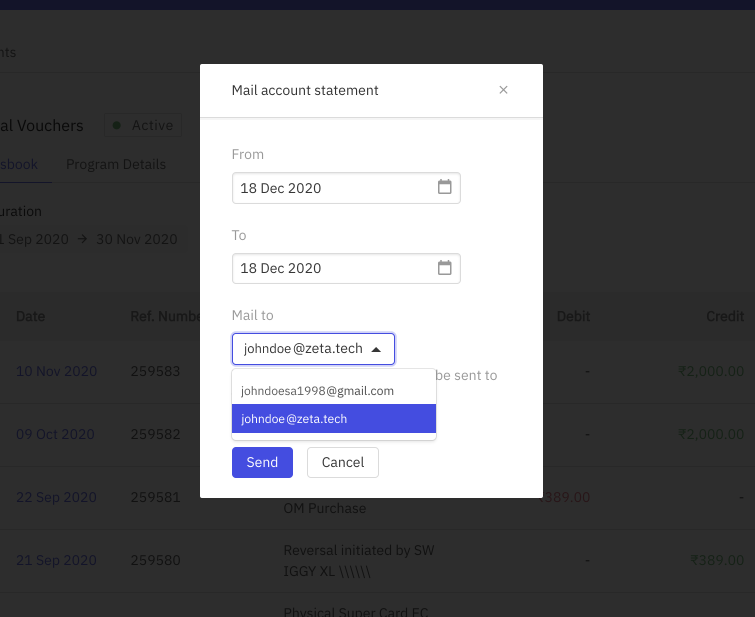

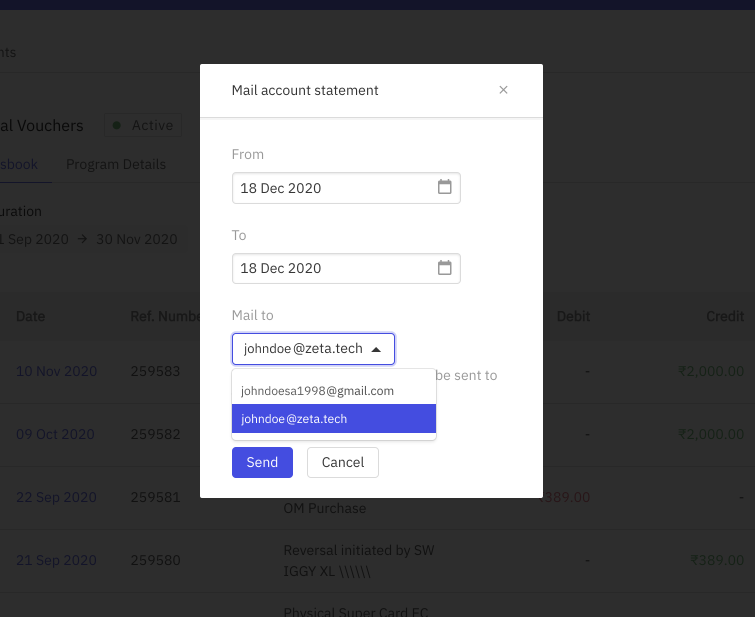

-

Email Statement

Feature highlight is as follows:

- Mail statement for all types of accounts

- Understands and works for all defined currencies and currency formats.

- Statement can be sent to verified email vectors only

- Available format is XLS only for now. PDF is WIP.

- Duration is 6 months. (Working to increase this to up to 2 years)

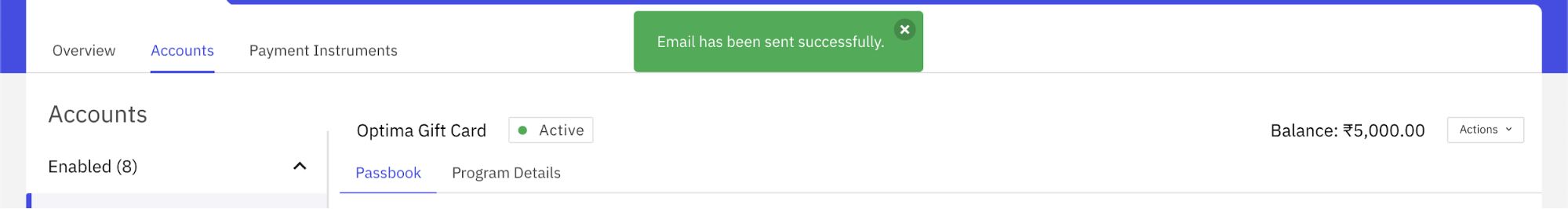

Once the user selects a verified email ID, the system will generate an email and send it to the user. The following success notifications would be delivered to the support and the account holder respectively.

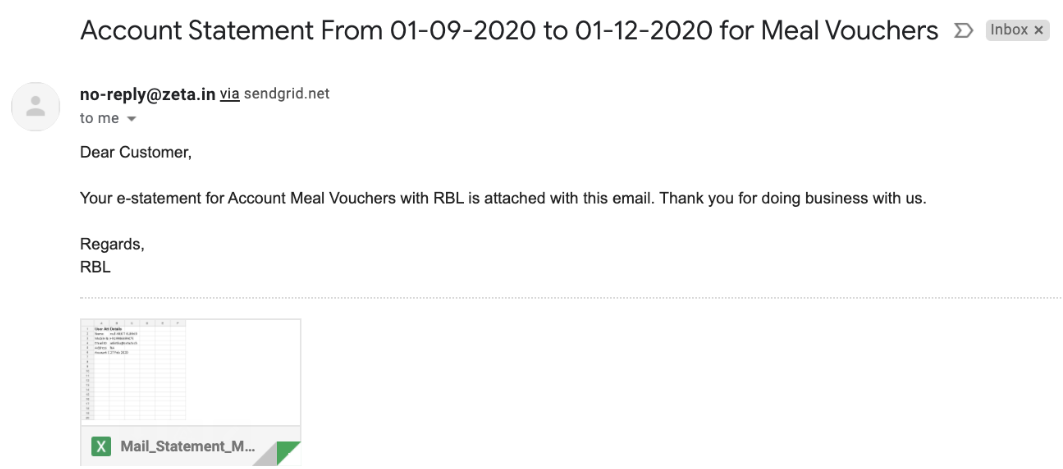

Here is a sample Email Statement.