What is Support Center?

Support Center is a tool that helps the customer relationship division within a Fintech to better manage its customer interactions. Support centre provides comprehensive dashboard and tools using extensible integrations to help resolve customer issues quickly, to track customer engagements, and to capture interaction and performance data. It can be operated either by an internal department or outsourced to a third-party provider.

Getting Started

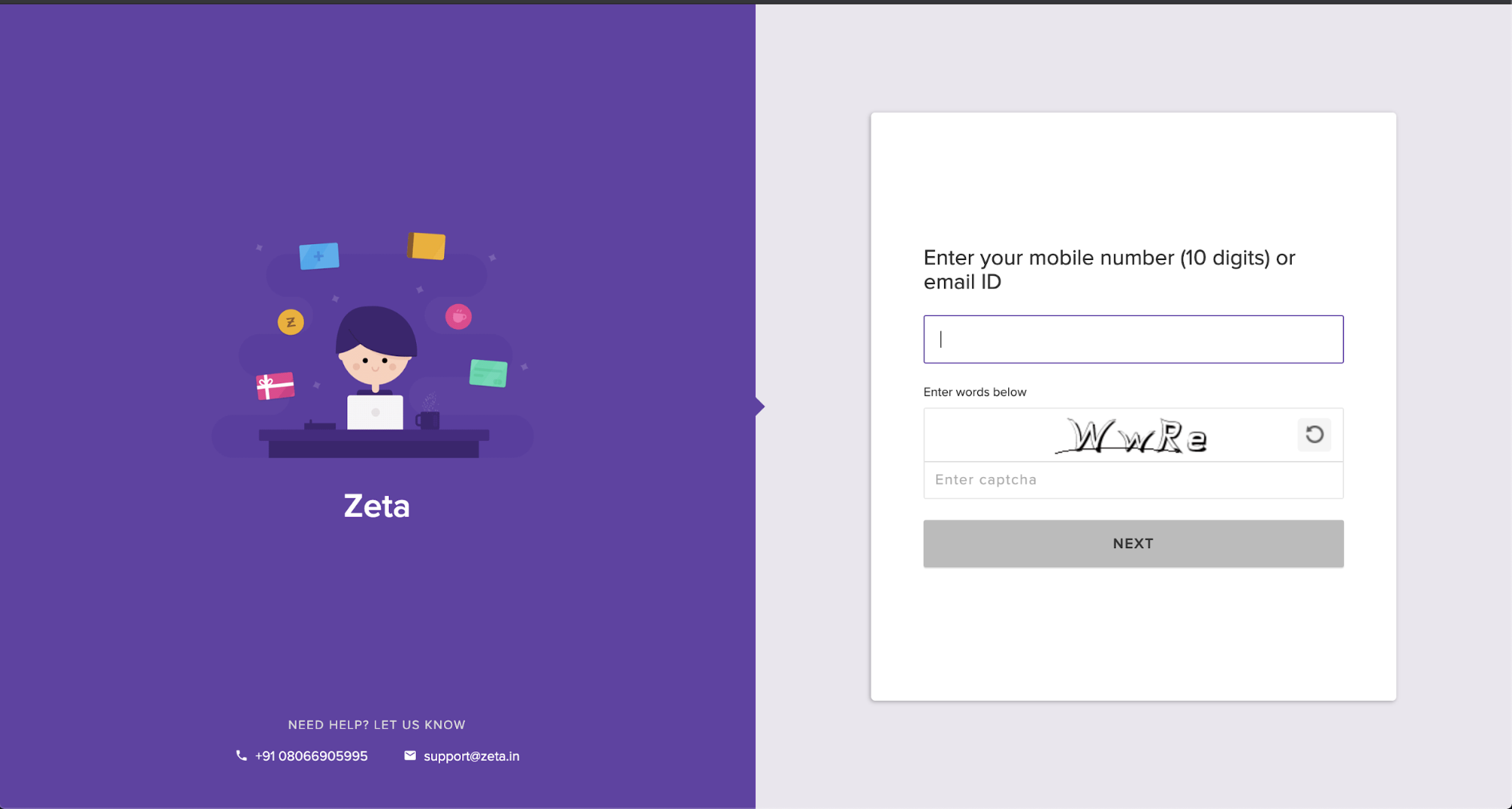

Logging In

Support executives with access to an instance of support center can login to it via:

- Entering their 10 digit phone number or email ID.

- Verifying the identity via OTP sent to the registered phone or email.

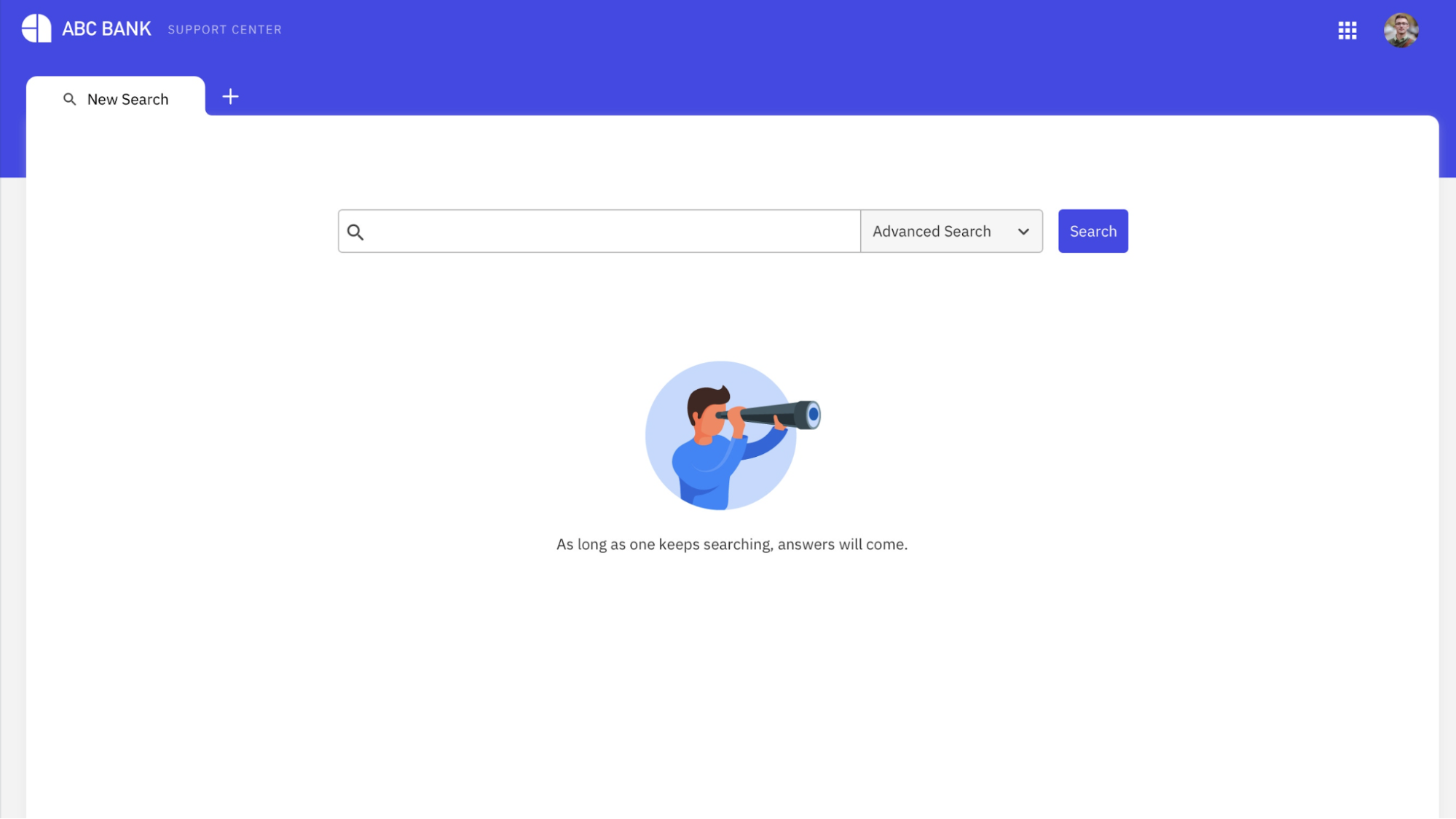

Landing Page & Profile Search

Default Landing Page

On the default landing page, Support center presents the support executive with an option to search for any account holder associated with the Fintech.

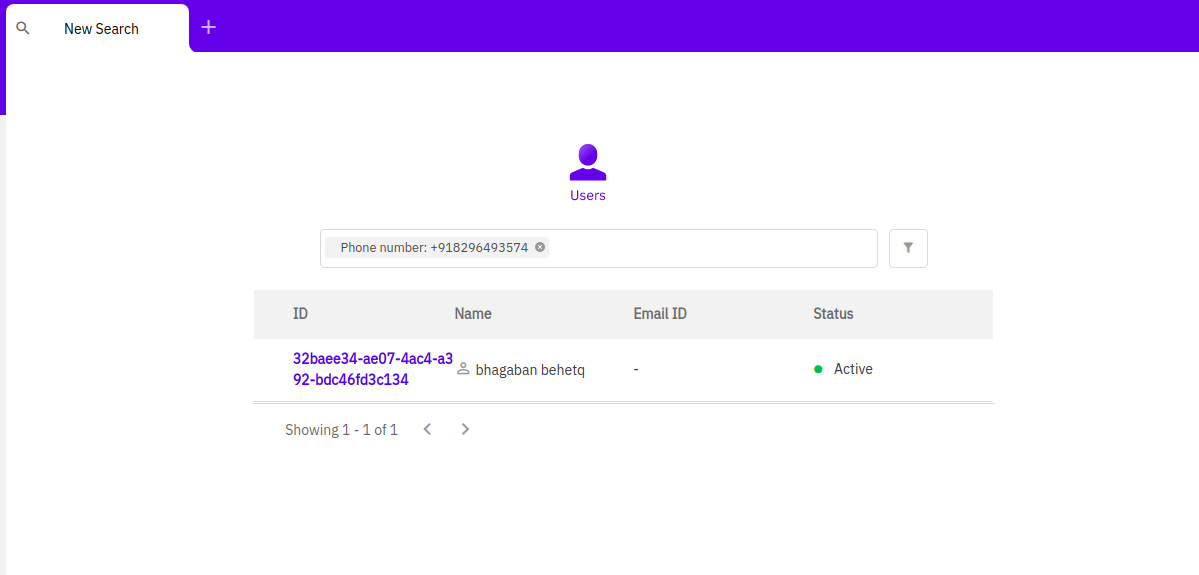

Search

Support executives can search for a profile by entering details of the account holder.

The profile attributes required for searching any account holder may differ for each issuer and can be configured during support center setup. By default, the following search attributes are enabled by default:

- Account Holder ID

- Name

- Phone Number

- Card Number

If any account holders are found that match search values then the results would be shown on the screen in a paginated fashion. The following attributes for all matching account holders are shown by default:

- Account Holder ID

- Name

- Phone or email

- Account Holder Status

Profile can be accessed by clicking on the Account Holder ID.

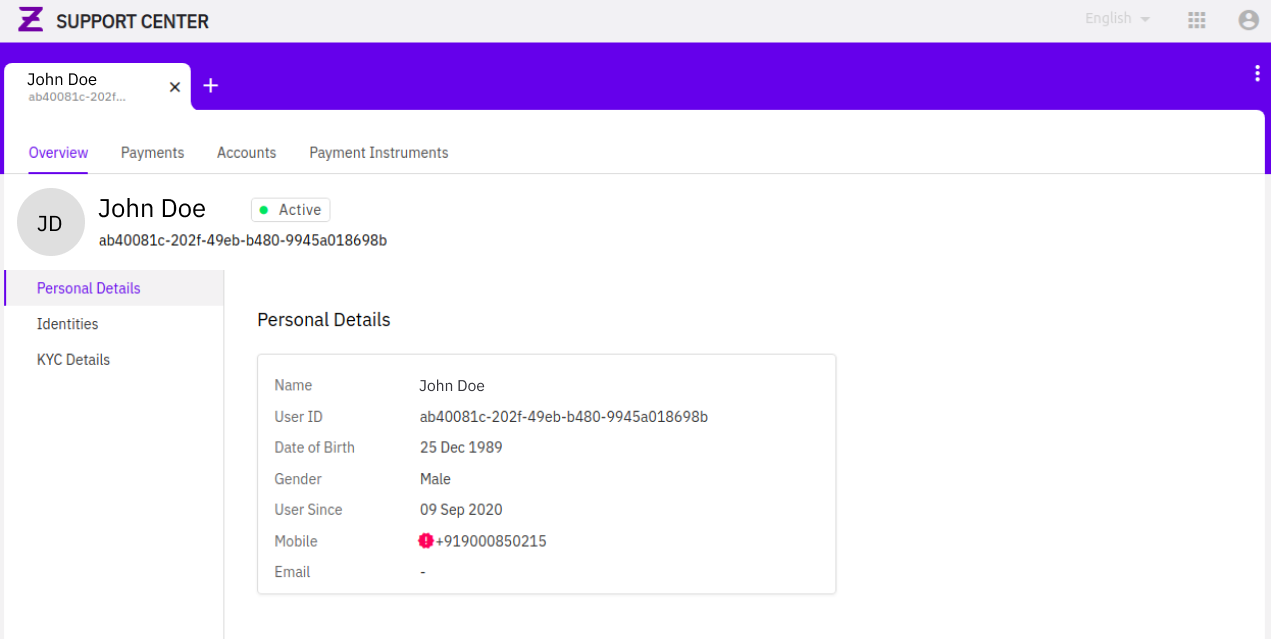

Real Account Holder or User Profile

As described above, a real account holder is an individual who can be identified and authenticated using various identifiers and authentication procedures prescribed by the regulatory bodies and configured by the issuer. This view is only available to issuers who have products configured that require real account holders.

Support center organises information available for every real account holder in the following sections.

Overview Tab

This tab collates all personal, professional and KYC related information of the account holder.

Details Captured

The following information is displayed as available for every account holder:

- Personal information

- Full Name

- User ID

- User Since

- Data of Birth

- Gender

- Mobile or Email

-

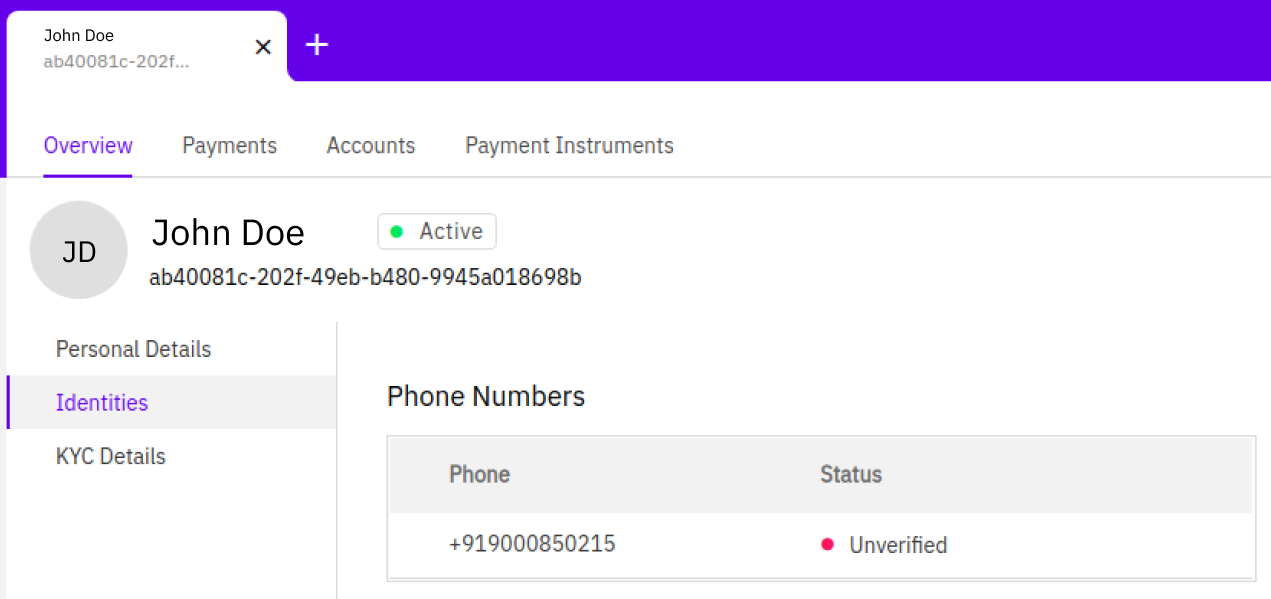

Identities

This refers to any unique vectors associated with the account holder with their verification status. Available vectors today are:

- Mobile Number

-

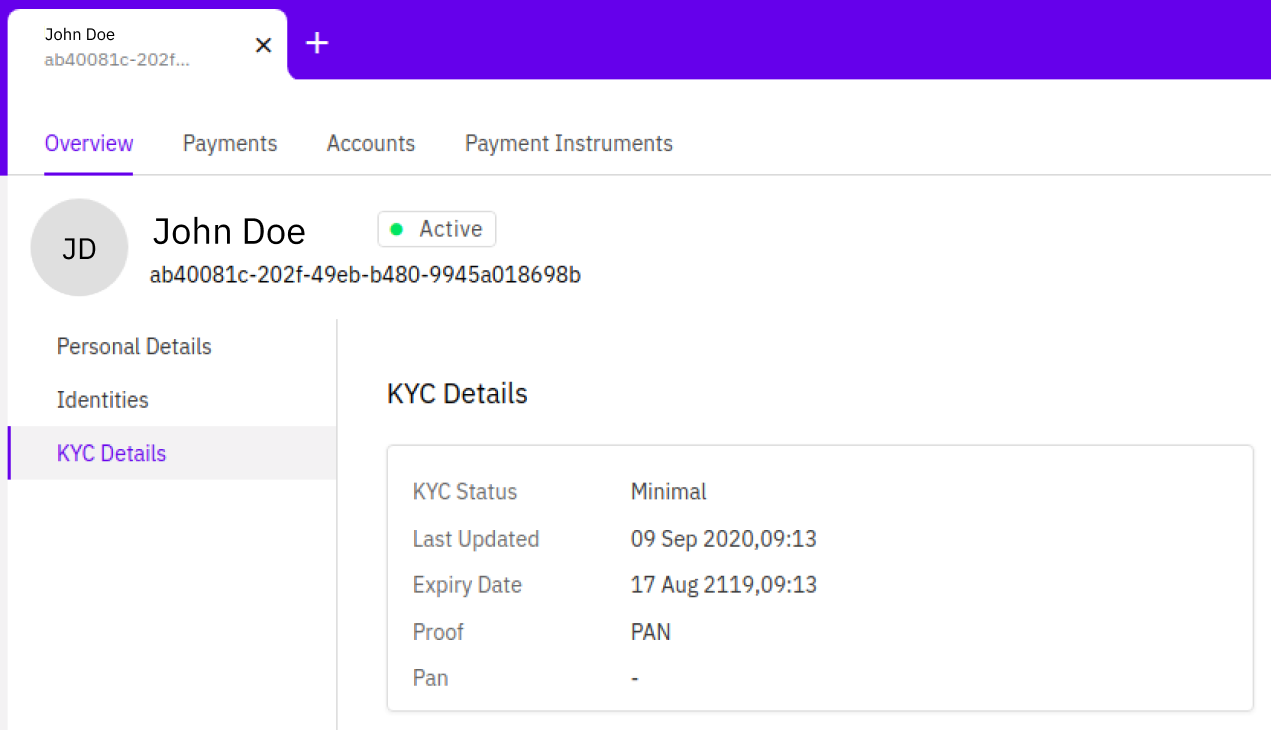

KYC Details

The following details are shown for every Account Holder basis availability:

- KYC status

- Expiry Date

- Last Updated On

- Proof

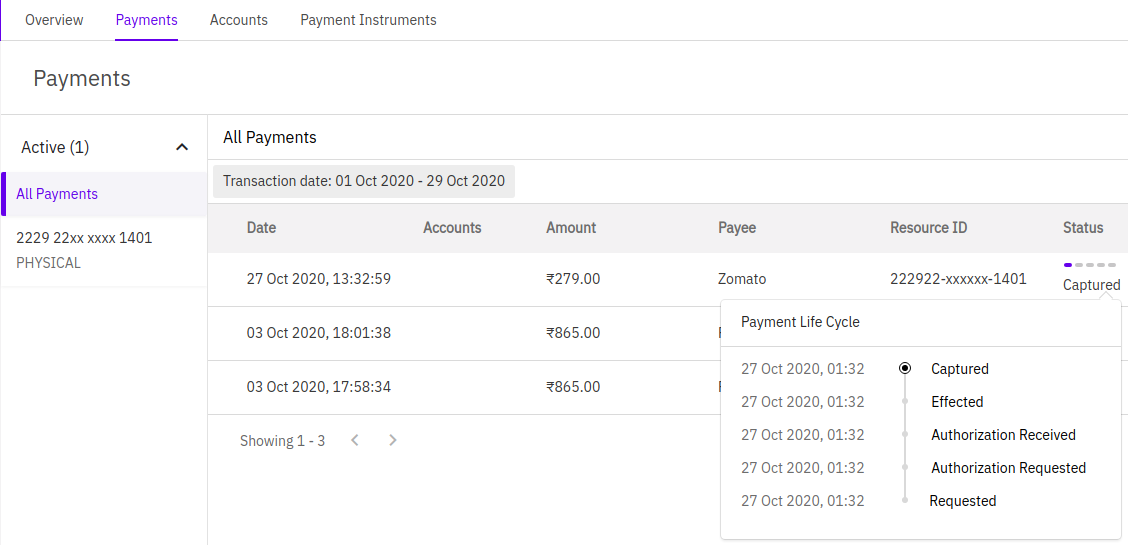

Payments Tab

This tab collates all payments attempted, successful or failed, by the user. It also provides a very detailed breakdown of the entire payment lifecycle. All payments attempted since 1st april 2020 all transactions should be accessible on Support Center.

Details Captured

The following details are currently captured on Payments tab:

- Date of transaction

- Details of the Payment instrument with which the payment was attempted

- Accounts involved

- Payee

- Amount for which the payment was initiated

- Payment Status

- Payment Lifecycle with timelines

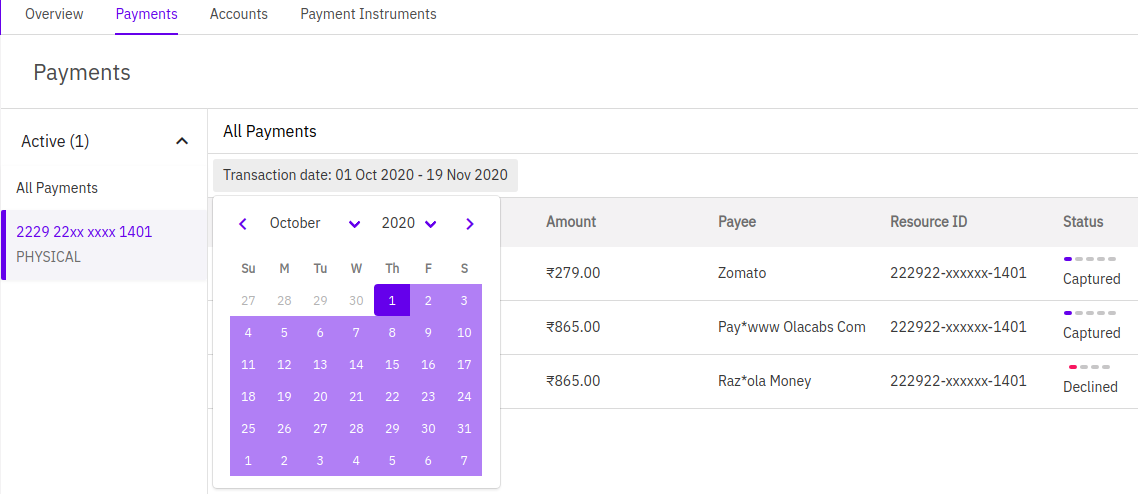

Support executives can also filter the payment list by:

- Transaction date

- Payment instrument

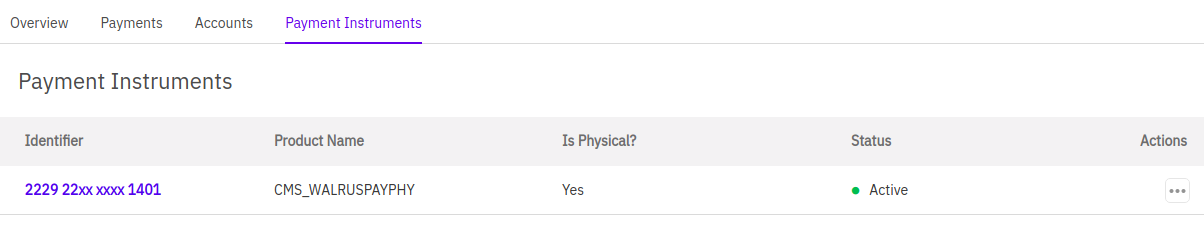

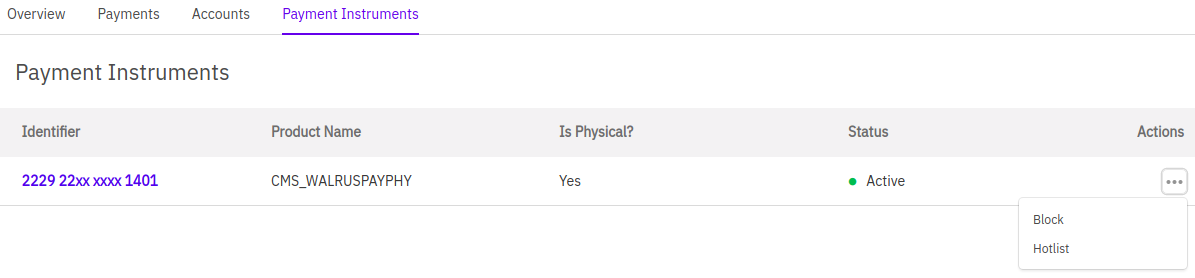

Payment Instruments Tab

This tab provides a consolidated view of all the payment instruments associated with an account holder.

Details Captured

The following details are shown for every payment instrument:

- Unique Identifier e.g. Masked Card Number

- Product Bundle Name

- IsPhysical?

- Status (Supported States : Active, Blocked, Hotlisted)

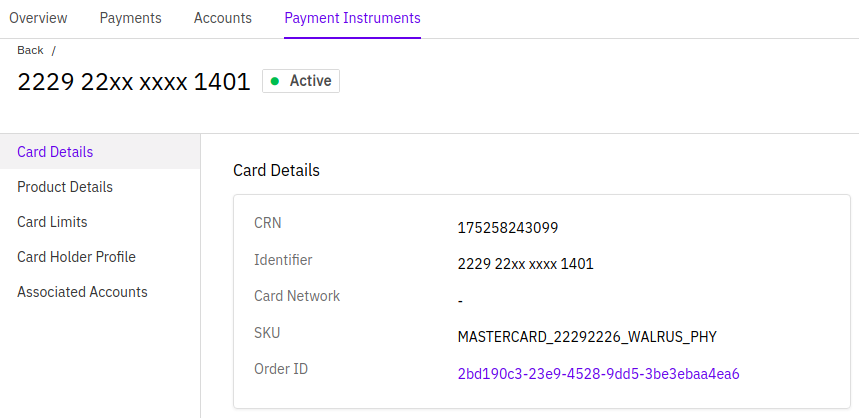

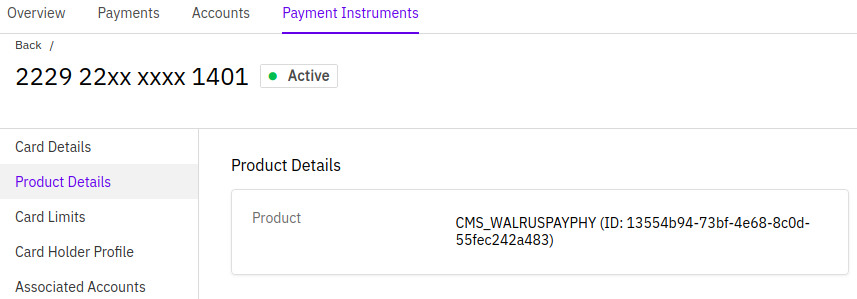

The following additional details can be revealed for every payment instrument on clicking the identifier. This screen differs for every payment instrument type.

For card payment instrument the following additional details are shown:

- Card Details

- CRN & SKU IDs

- Card Network

- Order Details

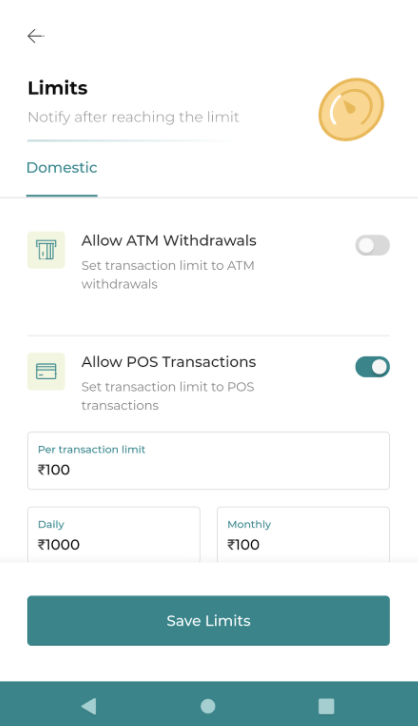

- Card Limits by Transaction category:

- POS Transaction

- E-Comm Transaction

- Domestic & International

- Additional details for debugging:

- Associated Accounts

- Card Holder Profile

- Product details

Allowed Actions

-

Block/Unblock Card

Feature highlight is as follows:

- This is a temporary block applied on the card that can be reversed.

- All Blocked cards show up with ‘Blocked’ status on Support center.

- Blocked cards can be:

- Unblocked using

Unblock Action - Permanently blocked using

Hotlist Action

- Unblocked using

- This action doesn’t require any checkers to be completed.

-

Hotlist Card

Feature highlight is as follows:

- This is a permanent block applied on the card that cannot be reversed.

- Support executive needs to provide a remark for hotlisting the card. This reason is further available for any MIS or reporting use cases.

- This action doesn’t require any checkers to be completed.

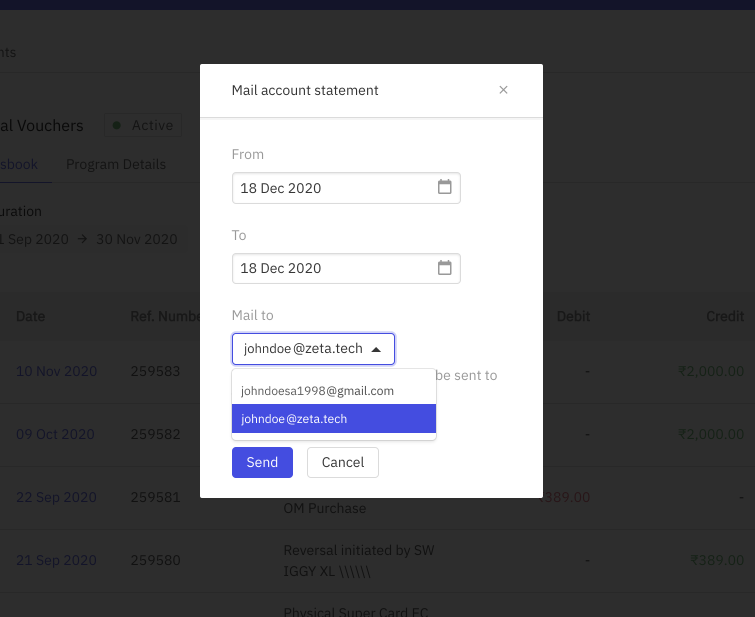

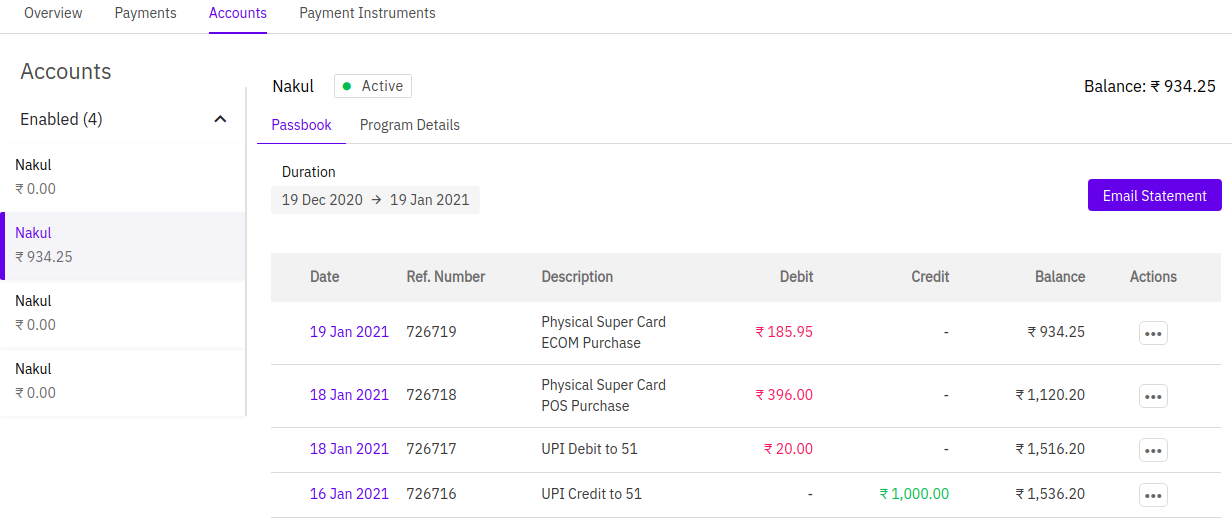

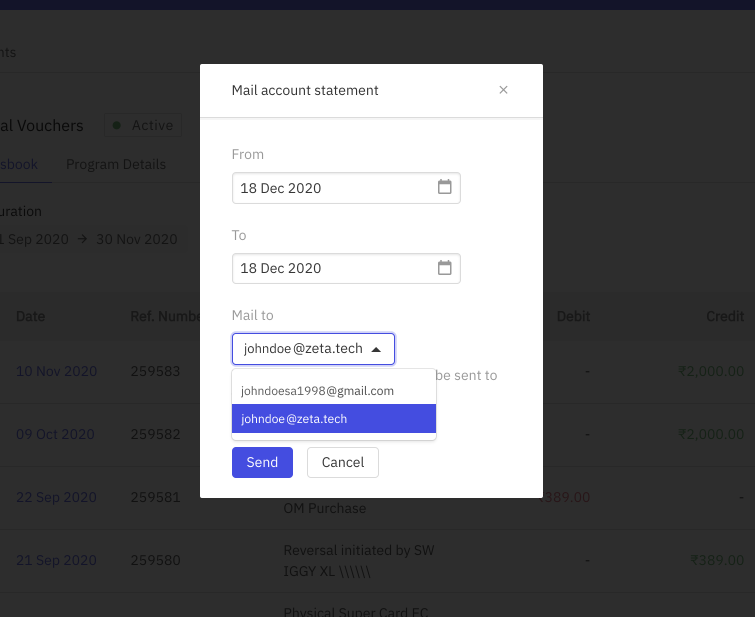

Accounts Tab

Details Captured

Allowed Actions

The following actions can be taken on every associated account:

-

Email Statement

Feature highlight is as follows:

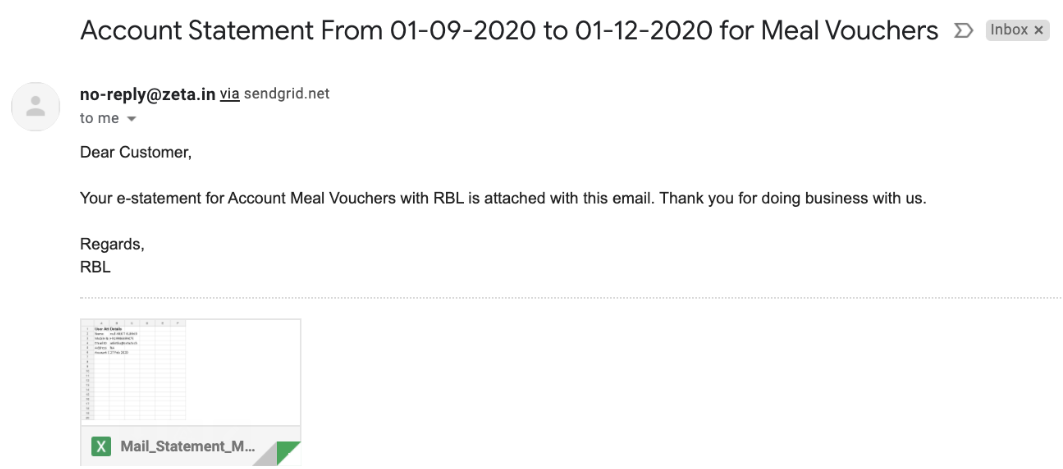

- Mail statement for all types of accounts

- Understands and works for all defined currencies and currency formats.

- Statement can be sent to verified email vectors only

- Available format is XLS only for now. PDF is WIP.

- Duration is 6 months. (Working to increase this to up to 2 years)

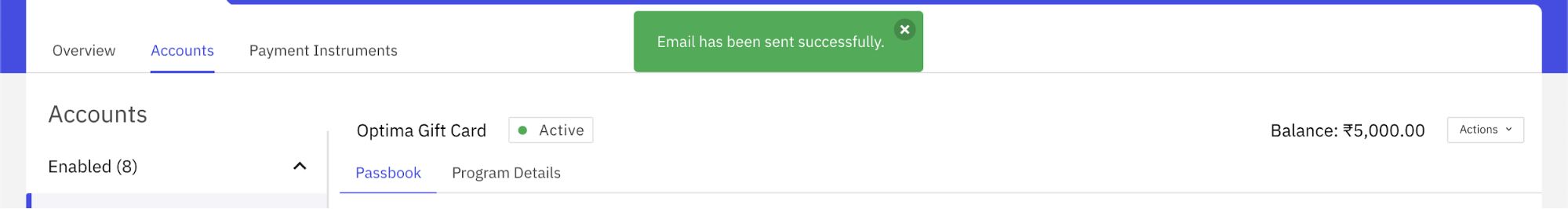

Once the user selects a verified email ID, the system will generate an email and send it to the user. The following success notifications would be delivered to the support and the account holder respectively.

Here is a sample Email Statement.